Market Watch: Higher Borrowing Costs Keep Buyers on Hold

Canadians scramble as mortgages set to renew

Market Watch To Your Inbox: October 2023

Lack of affordability and uncertainty remained issues for many would-be home buyers in the Greater Toronto Area (GTA) in October.

As the prospect of mortgage renewals draws near and concerns regarding interest rates come to the forefront, it’s important to remember that you’re not alone in grappling with this issue. With 100,000 Canadian mortgages up for renewal every month, many people are feeling the impact of elevated rates. However, economists are predicting the potential for a decline in rates around the middle of 2024. It’s important to prepare for the renewal process ahead of time, and to shop around and compare mortgage rates available elsewhere. Renewing with your current lender is generally the path of least resistance, but it’s important to consider all options and negotiate a more suitable arrangement if necessary.

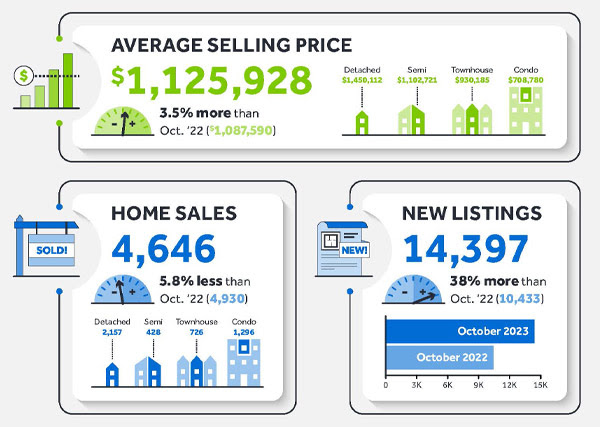

Explore TRREB’s Market Stats infographic for an easy-to-understand look at the housing market.