BC’s New Foreign Buyer Tax

On July 25th, British Columbia’s Premier Christy Clark announced a forthcoming 15% tax on non-Canadians buying residential real estate in order to curb the Vancouver area’s overheated housing market. There has been a wide array of reactions to the new tax, although the consensus is that it was long overdue.

“I want to keep home ownership within the grasp of the middle class in British Columbia,” Ms. Clark said at a news conference in Victoria.

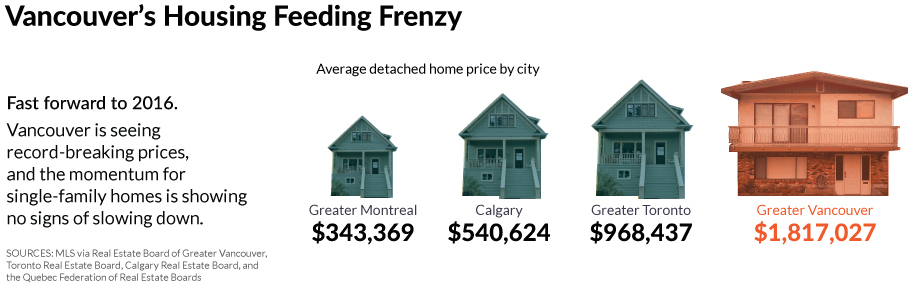

Vancouver’s real estate has captured the world’s attention with it’s unprecedented growth in the past decade, with the result being that locals are being crowded out by growing costs and demand from predominantly foreign investors. The 15% tax has been put into place to cool the pace of the market and create a disincentive for investment while also hoping to improve the domestic political environment.

There remains looming concerns over whether the Toronto real estate market may require such an intervention as well. Stuart Levings, president and CEO of Genworth MI Canada, said that without similar action in Ontario, foreign investors may simply head there next.

“If you tighten up Vancouver and not Toronto, what was going to Vancouver is just going to go to Toronto,” he said. “So we’re shifting the problem from the west coast to Central Canada.”

History has shown that the reality of a self-regulated market is that foreign investment speculators are going to use the regulatory framework to their advantage. In this sense, it’s the responsibility of Canadian political leaders to intervene as opposed to foreign governments trying to control how their citizens invest.

What do you think about the tax-hike, should Ontario implement something similar?