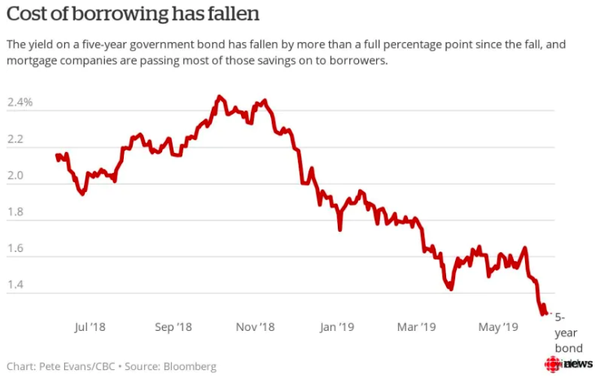

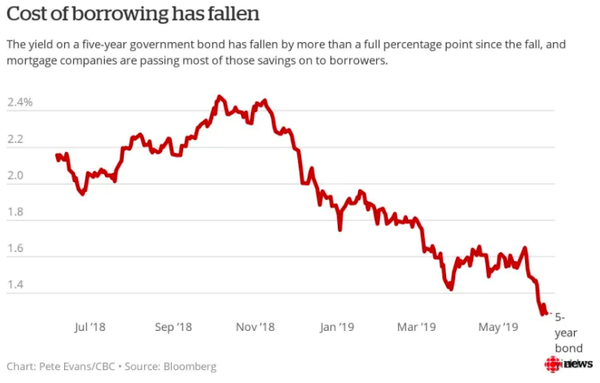

⏱️ Time To Refinance 🏠! Rates At 2-Year Low!

Cost of Borrowing Cheapest in 2 Years!

While house prices may be sky-high in many parts of Canada, home owners are being offered some of the lowest mortgage rates seen in years thanks to low bond & Bank of Canada Benchmark Rates.

NOW Is the Perfect time to Refinance your Mortgage

- Bank of Canada Benchmark Rate at 1.75%

- Variable Rates starting as low as 2.75%

- Fixed rates starting as low as 2.84%

Reasons to Refinance Before Your Term Is Up:

At Matrix Mortgage Global, we help hundreds of homeowners like you find solutions to their individual needs using their home equity.

- Inject Cash into your Business

- Renovations! Finish the basement, upgrade kitchen, build out back patio, etc.

- Combine 1st and 2nd mortgage into new lower rate

- Pay off high interest credit cards, save $100’s-$1000+ in monthly payments

- Get funds for down payment to Buy a lucrative Investment property

- Pay off mortgage and tax arrears

- Improve Your Credit and payoff consumer proposals

GET APPROVED IN MINUTES

CALL 855.55.FUNDS